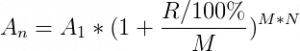

Compound interest calculation formula:

A1 – initial amount

An – amount after n years (or days/weeks/months)

R – nominal annual interest rate

M – number of compounding periods in one year

N – number of years (or days/weeks/months)

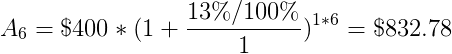

Example #1

Initial amount (A1) = $400

Number of years (N) = 6

Nominal annual interest rate (R), compounded yearly = 13%

So,

Number of compounding periods in one year (M) = 1

Amount after 6 years:

Interest amount = $832.78 – $400 = $432.78

Total yield = ($832.78 – $400) / $400 x 100% = 108.2%

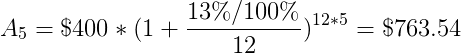

Example #2

Initial amount (A1) = $400

Number of years (N) = 5

Nominal annual interest rate (R), compounded monthly = 13%

So,

Number of compounding periods in one year (M) = 12

Amount after 5 years:

Interest amount = $763.54 – $400 = $363.54

Total yield = ($763.54 – $400) / $400 x 100% = 90.9%

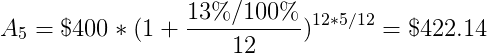

Example #3

Initial amount (A1) = $400

Number of months (N) = 5

Nominal annual interest rate (R), compounded monthly = 13%

So,

Number of compounding periods in one year (M) = 12

Amount after 5 months:

Interest amount = $422.14 – $400 = $22.14

Total yield = ($422.14 – $400) / $400 x 100% = 5.54%